Understanding Zakat: A Comprehensive Guide

Understanding Zakat: A Comprehensive Guide

Zakat is one of the five pillars of Islam, embodying the principle of social justice and compassion towards those in need. It comes from an Arabic word meaning "to purify," signifying how it cleanses our wealth and strengthens our connection to the community.

In this guide, we'll explore what Zakat is, why it matters, how to calculate it, and how it helps people in need. Whether you're new to Zakat or looking to deepen your understanding, let's explore together.

What is Zakat?

Zakat, an Arabic term meaning "purification" or "growth," holds profound significance in Islam as one of the Five Pillars. It represents a mandatory form of charitable giving, where Muslims contribute a portion of their wealth to support the less fortunate.

In the Quran, Allah emphasises the importance of Zakat as a means of purifying wealth and blessing it with growth:

“And establish prayer and give Zakat, and whatever good you put forward for yourselves – you will find it with Allah."

(Surah Al-Baqarah, verse 110)

Zakat is a mandatory obligation for Muslims who possess wealth above a certain threshold known as "nisab." It encompasses various categories of wealth, including savings, investments, gold, silver, livestock, and agricultural produce. Each category is subject to specific Zakat rates, ensuring a fair and equitable distribution of wealth.

The recipients of Zakat are the poor, needy, debtors, wayfarers, and those working in its collection and distribution. By fulfilling the duty of Zakat, Muslims demonstrate their commitment to social welfare, economic equity, and compassion for those in need.

The Prophet Muhammad (peace be upon him) highlighted its significance, stating:

“Whoever pays the zakat on his wealth will have its evil removed from him."

(Ibn Khuzaimah and at-Tabarani)

Why is Zakat Important?

Zakat holds immense significance in Islam, representing a fundamental pillar of faith that embodies the principles of social justice, compassion, and generosity. Its importance is underscored by the teachings of the Quran and the Sunnah of the Prophet Muhammad (peace be upon him), which emphasise the following key aspects:

1. Fulfilment of the Five Pillars

Fulfilling the five pillars of Islam is fundamental for Muslims. Each of these pillars has its unique significance and relevance in our lives. Zakat, one of these pillars, holds special importance for many reasons. It underscores our obligation to support one another and imparts valuable insights about our relationship with wealth.

2. Increases Closeness to Allah and faith

Zakat not only fulfils an obligation but also deepens the believer's connection with Allah and strengthens their faith.

In a hadith narrated by Prophet Muhammad (peace be upon him) which emphasises the importance of giving Zakat and its spiritual rewards:

“There is no envy except in two: a person whom Allah has given wealth and he spends it in the right way, and a person whom Allah has given wisdom (i.e. religious knowledge) and he gives his decisions accordingly and teaches it to the others."

(Sahih Bukhari, 490)

It serves as a means of drawing closer to Allah and increasing one's devotion and piety. By fulfilling this religious duty, Muslims express their obedience to Allah's commandments and demonstrate their commitment to living a righteous and spiritually fulfilling life.

Through the act of giving, individuals cultivate a sense of humility, gratitude, and trust in Allah's providence, thereby enriching their spiritual journey and fostering a deeper sense of closeness to their Creator.

3. Wealth Purification

Zakat serves as a means of purifying one's wealth, both materially and spiritually. By giving a portion of their earnings to those in need, individuals cleanse their possessions.

In a hadith narrated by Prophet Muhammad (peace be upon him), he stated:

“Allah says, ‘Spend, O son of Adam, and I shall spend on you. The right hand of Allah is full and overflowing and in nothing would diminish it, by overspending day and night"

(Sahih Muslim, 2178)

It simply means that our wealth is never going to decrease if we spend it on the poor. On the contrary, Allah will increase it many times.

This act of purification not only benefits the recipient but also elevates the giver's wealth to a higher spiritual status, free from the negative effects of greed, selfishness, and attachment to worldly possessions.

Through Zakat, believers cultivate a sense of contentment, generosity, and detachment from material wealth, thereby purifying their hearts and souls in the process.

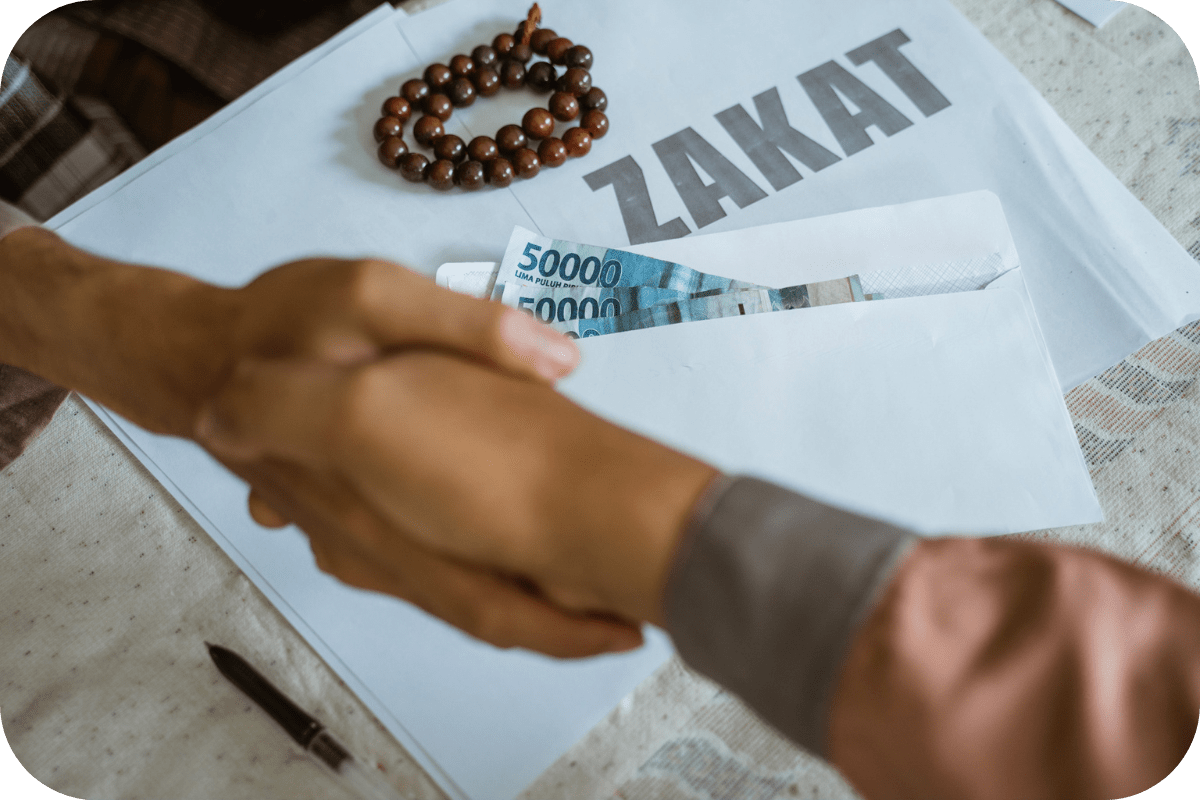

4. Redistribution of Wealth

In Islam, wealth is viewed as a trust from Allah, to be shared equitably among all members of society. Zakat plays a crucial role in ensuring the fair distribution of wealth and resources, particularly to those who are less fortunate or in need.

The impact of Zakat in the UK is evident through the work of organisations like the Zakat National Foundation, which in February alone, distributed £406,001 in Zakat, assisting 1,606 Muslims. This reflects a larger trend, with 3,382 Muslims aided so far during 2024.

These numbers underscore the tangible impact of Zakat in supporting individuals and families, and can be seen as follows:

- Restore and establish human dignity by reducing poverty and giving hope to the less fortunate

- Reduce poverty by redistributing wealth to those in need.

- Bridge the gap between the rich and poor, promoting social equality.

- Eliminate social conflicts and establish social security.

- Encourage selflessness and giving within the community

By obligating Muslims to give a portion of their wealth to the poor and needy, Zakat promotes social justice, economic equality, and solidarity within the community. It serves as a mechanism for wealth redistribution, empowering marginalised individuals and families to meet their basic needs and participate more fully in society.

Through Zakat, believers fulfil their duty to uphold the rights of the less fortunate and contribute to building a more just and compassionate society.

5. Relief of Suffering and Community Support

According to data from the Muslim Council of Britain, 50% of UK Muslims are already living below the poverty line! Zakat serves as a powerful instrument for relieving the suffering of those vulnerable and marginalised members of society.

By providing financial assistance to those in need, Zakat offers tangible relief from poverty, hunger, and hardship, allowing individuals and families to access essential resources and services.

Which has a profound impact on communities, fostering solidarity and support among believers. Through collective giving and mutual aid, Zakat strengthens the bonds of brotherhood and compassion within the Muslim community, enabling individuals to overcome difficulties and thrive together.

Through collective giving and mutual aid, Zakat strengthens the bonds of brotherhood and compassion within the Muslim community, enabling individuals to overcome difficulties and build a brighter future together.

Who is Required to Pay Zakat?

Zakat is obligatory for adult Muslims who possess wealth above a certain threshold, known as the Nisab. This includes savings, investments, gold, silver, and other assets that have been held for one lunar year.

There are two main thresholds depending on the school of thought (madhab) followed:

- According to the Hanafi school, the Nisab is calculated based on silver, equivalent to 612.36 grams, or its cash value. To provide a clearer example: If the current market value of silver is £0.57 per gram, then the Nisab would be calculated as 612.36 grams x £0.57 = £349.27.

- According to the Maliki, Shafi'i, and Hanbali schools, the Nisab is based on gold, equivalent to 87.48 grams, or its cash value. To provide a clearer example: Assuming the current market value of gold is $65.43 per gram, then the Nisab would be calculated as 87.48 grams x $65.43 = £5,723.81.

Individuals must have wealth that exceeds the Nisab and is considered surplus to their basic needs in order to be eligible to pay Zakat. Those who meet these criteria are required to fulfil this important religious obligation to purify their wealth and contribute to the welfare of the less fortunate members of society.

How is Zakat Calculated?

The calculation of Zakat is based on the value of eligible assets owned by an individual and the applicable Zakat rate, typically set at 2.5% of the total value. Eligible assets include savings, investments, gold, silver, and business inventory that have been held for one lunar year. However, certain assets are exempt from Zakat, such as primary residences, personal vehicles, and household items used for daily living.

To determine the Zakat amount owed, one must assess the total value of their assets, deduct any outstanding debts, and then apply the Zakat rate to the remaining surplus wealth. This process ensures that Zakat is paid on wealth that has been held for a full lunar year and exceeds the Nisab threshold.

By calculating Zakat accurately and conscientiously, individuals fulfil their religious duty and contribute to the welfare of the community in accordance with Islamic teachings.

Distribution of Zakat

Zakat funds are distributed to eligible recipients in accordance with the guidelines outlined in Islam. These recipients include the poor, needy, indebted, wayfarer, and those employed to collect and distribute Zakat.

In determining eligibility, Islamic scholars and charitable organisations often consider various factors, including income level, financial stability, basic needs, and outstanding debts. While there are no strict monetary thresholds universally applied, recipients are typically those who lack the means to meet their essential needs and obligations.

The distribution of Zakat is intended to alleviate poverty, provide relief to those in need, and strengthen the social fabric of the community. Islamic scholars and charitable organisations play a crucial role in ensuring that Zakat funds are disbursed effectively and reach those who are most deserving.

By contributing to the distribution of Zakat, Muslims fulfil their obligation to support the less fortunate members of society and uphold the principles of social justice and compassion inherent in Islam.

Zakat vs. Sadaqah: What's the Difference?

While both Zakat and Sadaqah are forms of charitable giving in Islam, they differ in several key aspects:

Zakat is an obligatory form of charity that is specifically mandated in the Quran and Sunnah, with specific criteria for eligibility and calculation. It is a fixed percentage of one's wealth and is required to be paid annually. Sadaqah, on the other hand, is a voluntary charity that can be given at any time and in any amount, without the same strict guidelines as Zakat.

While Zakat is primarily aimed at alleviating poverty and fulfilling basic needs, Sadaqah encompasses a broader range of charitable acts, including acts of kindness, generosity, and compassion towards others.

Both Zakat and Sadaqah are important forms of charity in Islam, each serving its unique purpose in promoting social welfare and spiritual growth.

Common Misconceptions About Zakat

Despite its significance in Islam, Zakat is often misunderstood, leading to various misconceptions about its purpose, calculation, and distribution.

One common misconception is that Zakat is only obligatory on financial assets, when in fact it applies to a wide range of wealth. Zakat includes not only financial assets such as savings, investments, and cash, but also tangible assets like gold, silver, crops, and livestock.

Additionally, business investments and profits are also subject to Zakat. It's essential to understand the breadth of assets that Zakat encompasses to fulfil this religious obligation properly.

Another misconception is that Zakat is solely intended for Muslims, whereas in reality, Zakat can be used to support the needs of the wider community, regardless of religious affiliation. Additionally, there is a misconception that Zakat is a form of taxation imposed by the state, whereas it is actually a religious obligation incumbent upon individuals to fulfil voluntarily.

By addressing these misconceptions and promoting a deeper understanding of Zakat, we can ensure that this vital form of charity is practised correctly and effectively, benefiting those in need and strengthening the bonds of compassion and solidarity within society.

Conclusion

In conclusion, Zakat holds immense significance in Islam, embodying principles of social justice, compassion, and economic equity. It is a fundamental pillar of faith that serves to purify wealth, strengthen community bonds, and alleviate the suffering of those in need.

By fulfilling the obligation of Zakat, Muslims not only fulfil a religious duty but also contribute to the well-being of society and foster a culture of generosity and compassion. As we strive to uphold the teachings of Islam and live in accordance with its values, let us remember the importance of Zakat as a means of fulfilling our duty to Allah and serving humanity.

Buying at Riwaya

At Riwaya, we offer a wide range of high-quality Islamic products, including books, home decor, and fragrances, designed to enrich your spiritual journey and enhance your daily life.

Whether you're seeking authentic Islamic literature, exquisite home decor inspired by Islamic art and culture, or premium fragrances crafted with natural ingredients, Riwaya has something for everyone.

Explore our curated collection and discover unique products that reflect the beauty and richness of Islamic heritage.

Selling at Riwaya

If you're a seller or creator passionate about sharing your talents with the world, consider selling your products on Riwaya. Our platform provides a unique opportunity to showcase your craftsmanship and connect with a global audience of discerning customers who appreciate quality and authenticity.

Join our community of sellers and become part of a vibrant marketplace dedicated to promoting Islamic art, culture, and craftsmanship. Start selling at Riwaya today and share your creativity with the world.

FAQs

Q1: What is Zakat?

Zakat, an Arabic term meaning "purification" or "growth," is a mandatory form of charitable giving in Islam, designed to purify one's wealth and bless it with growth. It's one of the Five Pillars of Islam, obligating Muslims to give a portion of their wealth to support the less fortunate.

Q2: Who is required to pay Zakat?

Adult Muslims possessing wealth above the Nisab threshold, which varies based on school of thought, are required to pay Zakat. This includes savings, investments, gold, silver, and other assets held for one lunar year.

Q3: When is Zakat due?

Zakat is due once a lunar year has passed since the individual's wealth reached the Nisab threshold. The exact date for paying Zakat may vary depending on when the individual's wealth first reached the Nisab and when the lunar year ends. It is recommended to calculate and pay Zakat promptly to fulfil this important religious obligation.

Q4: What are the three types of Zakat?

The three types of Zakat are Zakat al-Fitr, Zakat al-Mal (or Zakat on wealth), and Zakat al-Tijarah (or Zakat on trade). Zakat al-Fitr is obligatory charity given before the Eid al-Fitr prayer at the end of Ramadan. Zakat al-Mal is the annual Zakat on wealth, which includes various assets such as money, gold, silver, business profits, and agricultural produce. Zakat al-Tijarah is Zakat due on merchandise or goods intended for trade.

Q5: What is Nisab?

Nisab is the threshold or minimum amount of wealth a Muslim must possess before being obligated to pay Zakat. It is based on the value of assets owned by an individual and varies based on schools of thought, calculated with gold or silver values.